|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Best Pet Insurance for Cane Corso: A Comprehensive GuideChoosing the best pet insurance for your Cane Corso can be a daunting task, given the size and specific health needs of this majestic breed. In this guide, we will explore the top insurance options, what to look for, and answer some frequently asked questions to help you make an informed decision. Why Cane Corsos Need InsuranceCane Corsos are known for their loyal nature and protective instincts. However, they are also prone to certain health issues such as hip dysplasia and bloat. Insurance can help manage unexpected veterinary costs, ensuring your pet receives the best care without breaking the bank. Common Health Issues

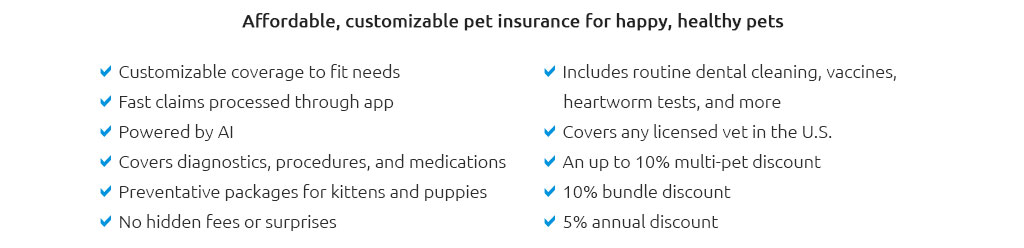

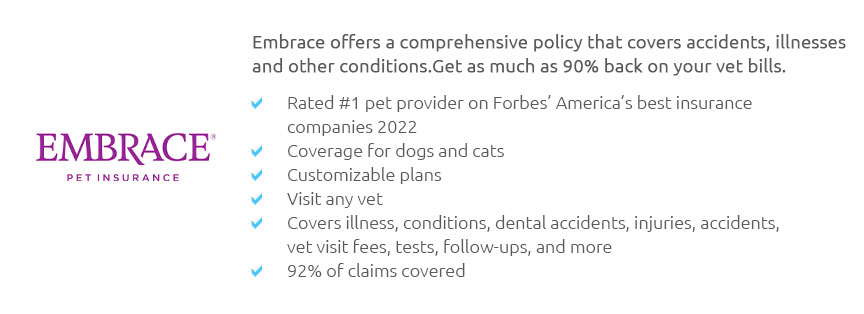

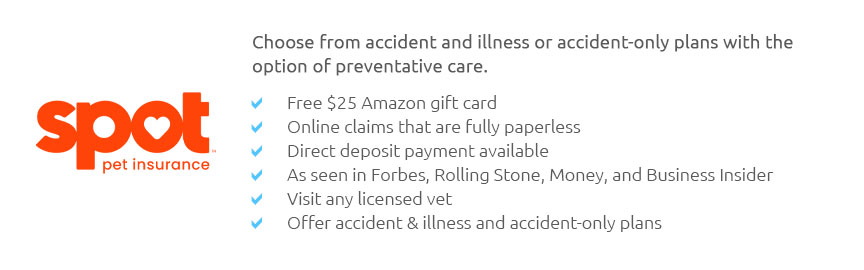

Top Pet Insurance Providers for Cane CorsoWhen selecting the best pet insurance, consider providers that offer comprehensive coverage and have a reputation for reliability. Here are some top contenders:

For more information on different pet insurance providers, check out this best pets health insurance resource. What to Look for in a PolicyWhen evaluating policies, pay attention to these key factors:

Cost of Insurance for Cane CorsoThe cost of insuring a Cane Corso can vary based on age, location, and health status. On average, expect to pay between $40 to $90 per month. While this might seem high, the peace of mind and potential savings in case of major health issues make it a worthwhile investment. Saving on PremiumsTo reduce costs, consider:

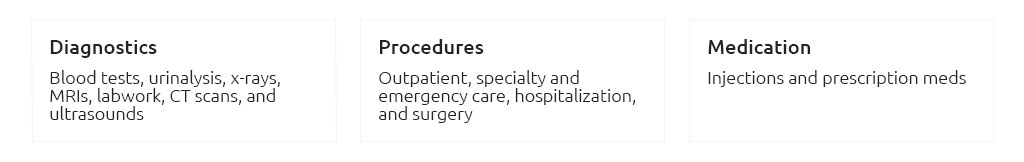

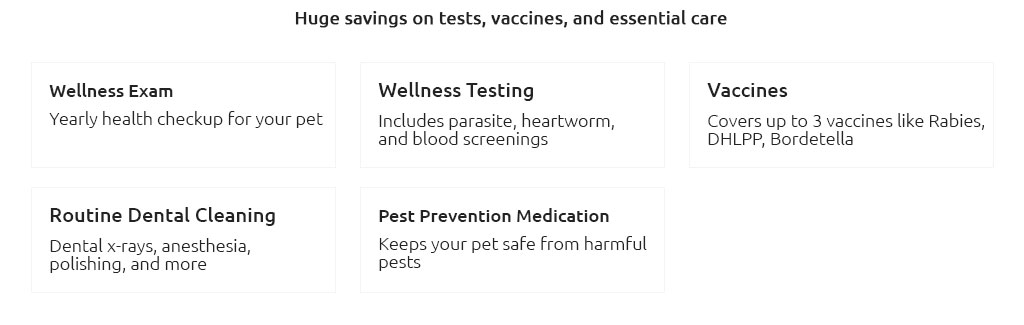

Find the best place to get pet insurance for more tips on saving. FAQWhat does pet insurance typically cover?Pet insurance usually covers accidents, illnesses, surgeries, medications, and sometimes wellness care. It's important to read the policy details to understand specific coverage. Are hereditary conditions covered in Cane Corsos?Many insurers, such as Petplan, cover hereditary conditions like hip dysplasia, but always verify with the provider to ensure coverage for specific conditions common in Cane Corsos. Can I get insurance if my Cane Corso has a pre-existing condition?While pre-existing conditions are generally not covered, some companies may offer limited coverage for certain manageable conditions. It's best to discuss your options directly with the insurance provider. https://www.reddit.com/r/CaneCorso/comments/vmoyy4/pet_insurance/

This is a good thought, and it is highly recommend investing in pet insurance, especially for large breeds like Cane Corso's. One important ... https://www.insuranceopedia.com/pet-insurance/pet-insurance-for-cane-corso

Based on my professional experience, Healthy Paws is the best pet insurance provider for Cane Corsos. We've saved shoppers an average of $350 per year on their ... https://www.fetchpet.com/pet-insurance/breeds/cane-corso

Cane Corso. Fetch Pet Insurance gives you unmatched coverage for the unexpected the injuries and illnesses you can't see coming. Add Fetch Wellness, and you' ...

|